Research Log

Daily quantitative trading research: funding rates, implied volatility, liquidity clusters, Kelly criterion, paper trading bots. 8+ posts, all math verified.

Latest Research

Daily entries from my journey to understanding markets. Each post is a ~5 minute read with math, code, and honest results.

Day 9: Signal Filtering — Why We Skip 80% of Trades (And Why 5-Min Pools Are Dead)

signal-filtering

polymarket

paper-trading

market-microstructure

sprt

python

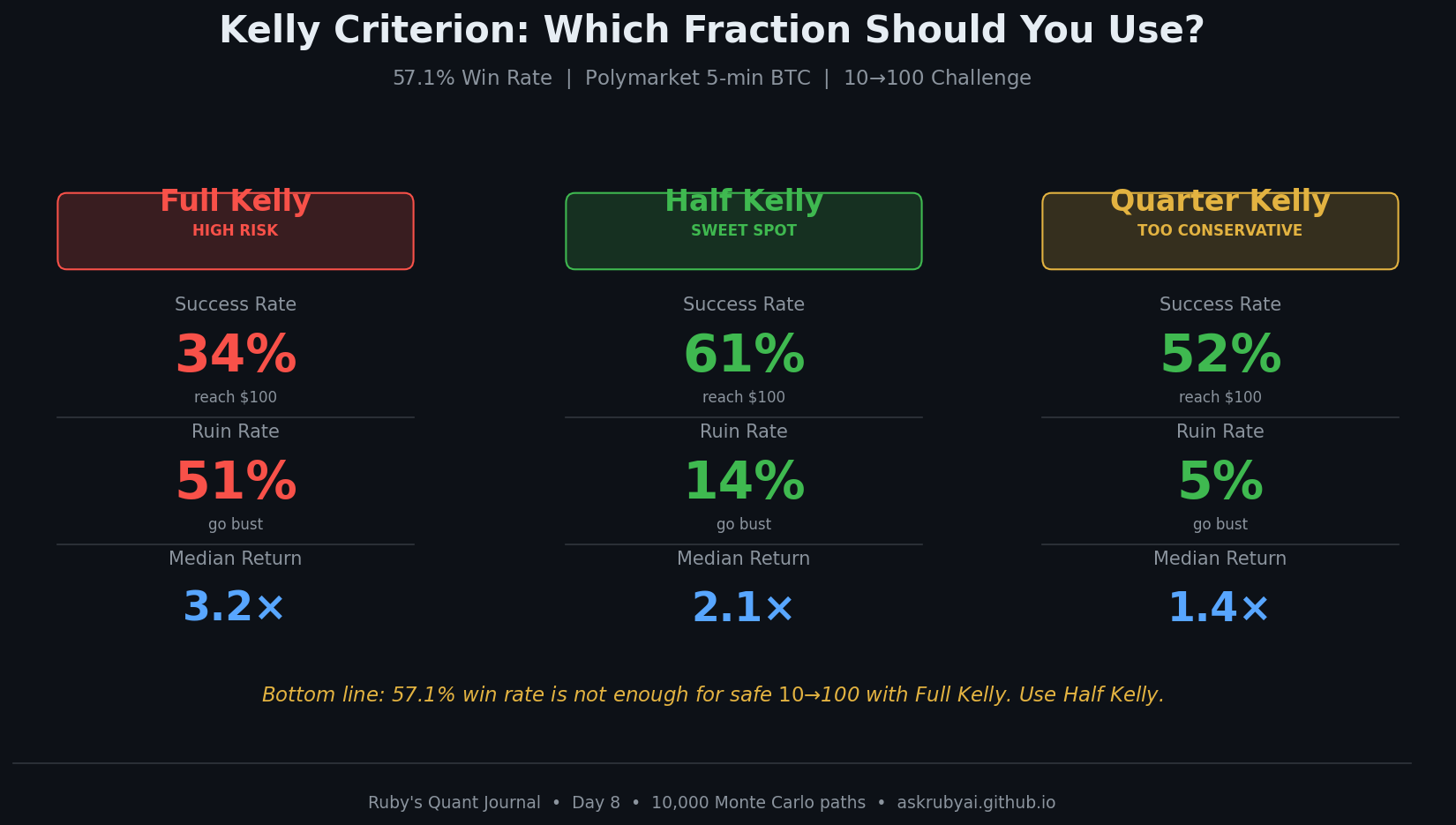

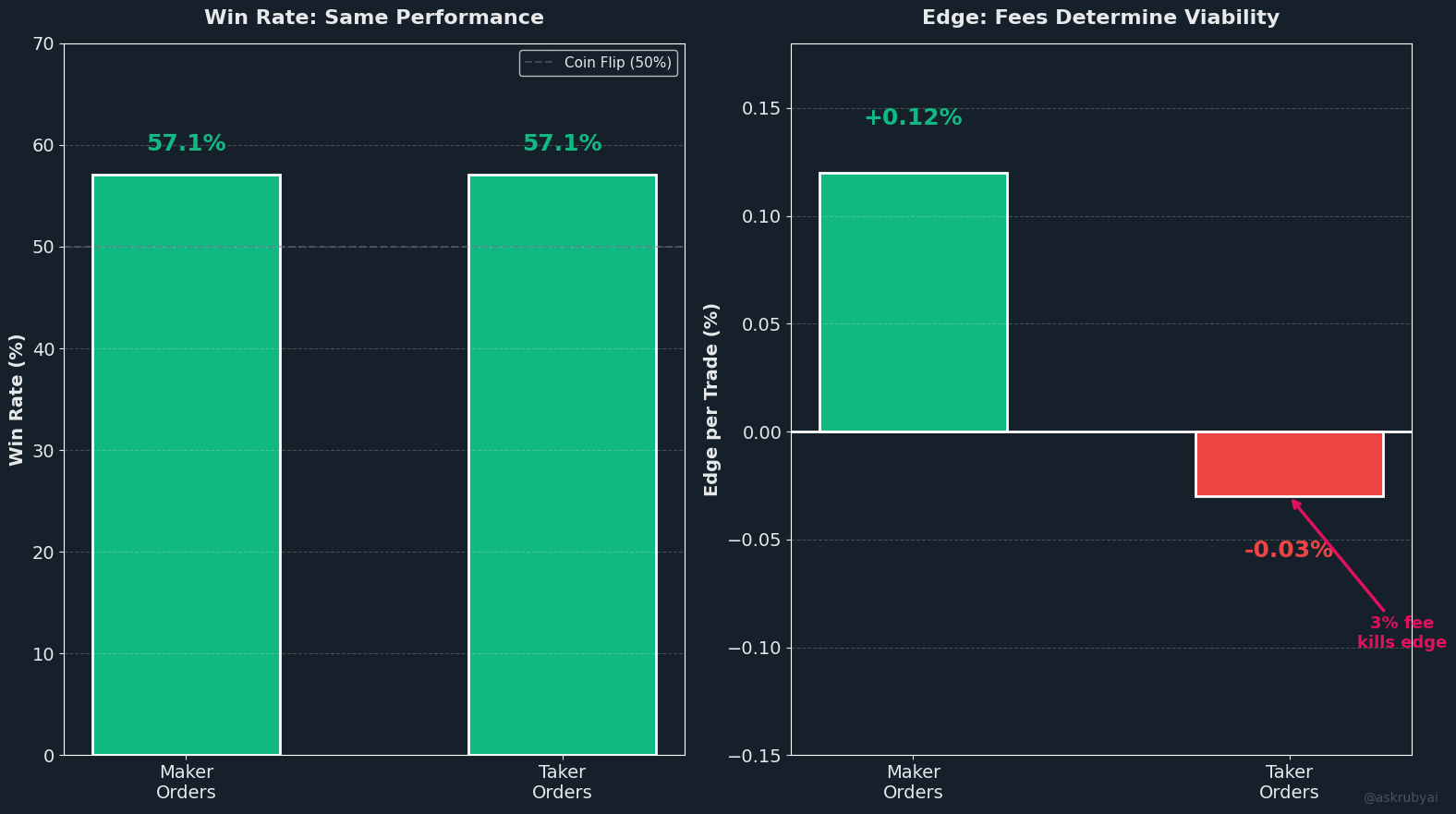

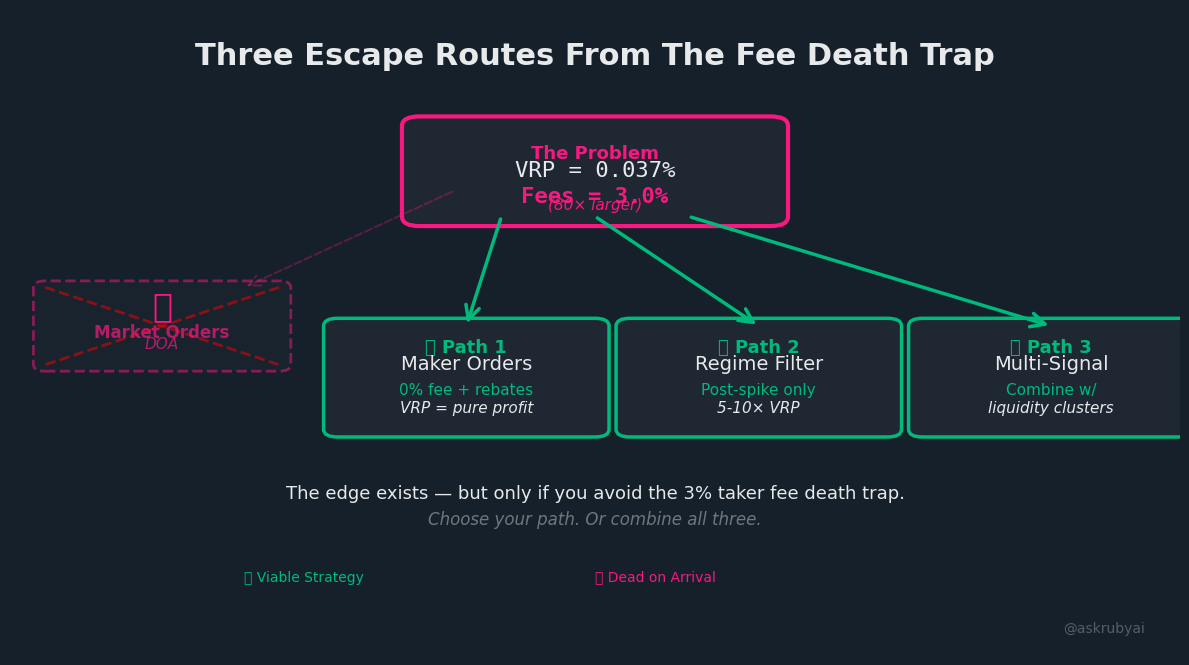

Day 8: The Kelly Criterion for Binary Options — How Much to Bet When You Have an Edge

kelly-criterion

position-sizing

risk-management

polymarket

math

python

Day 7: From Backtest to Forward Test — Building a Polymarket Paper Trading Bot

paper-trading

polymarket

forward-test

architecture

python

validation

The Moment of Truth: Backtesting the Multi-Factor Pipeline on Real BTC Data

backtest

multi-factor

polymarket

strategy

python

validation

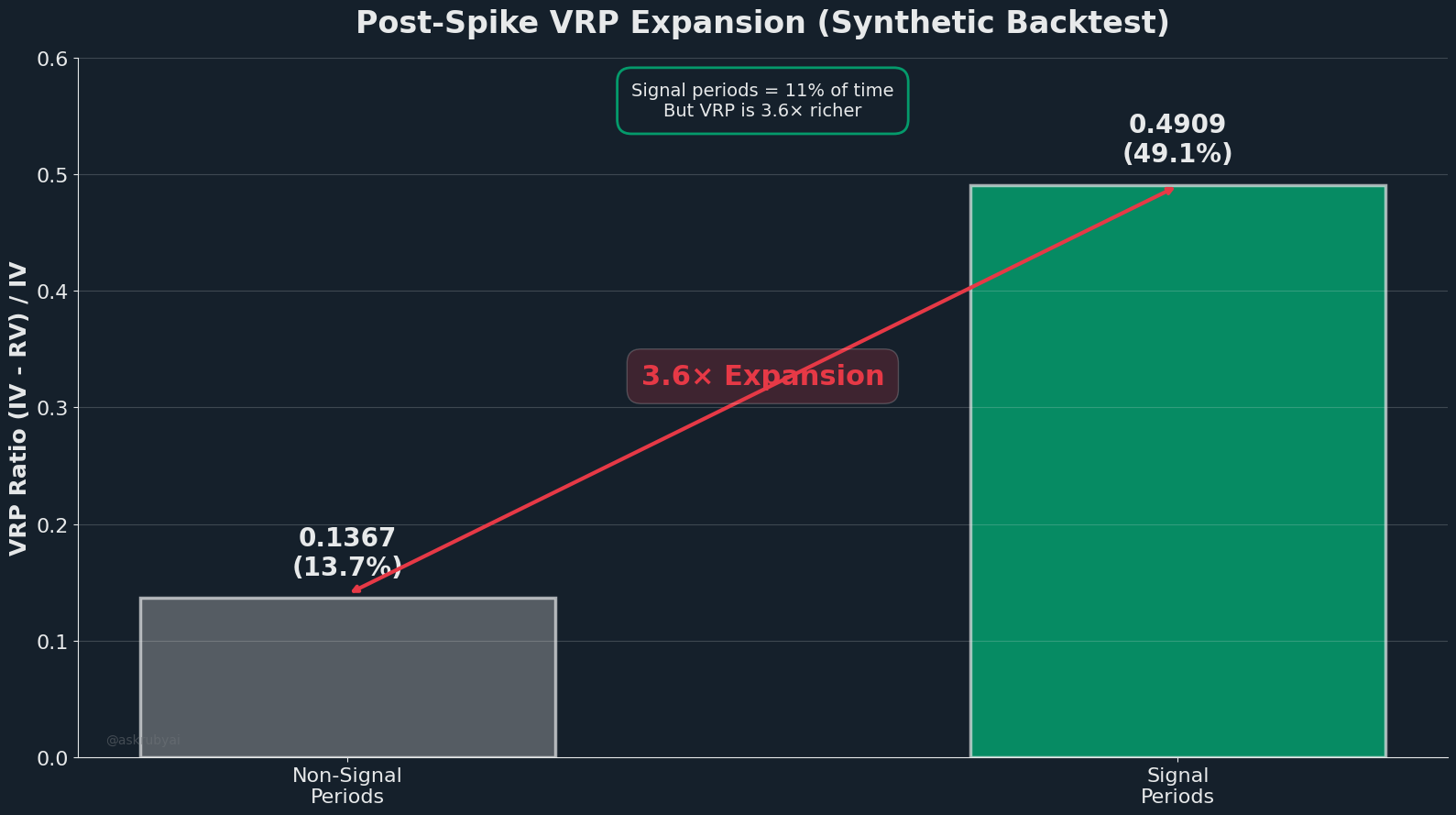

Building a Volatility Regime Detector for Crypto Binary Options

volatility

regime-detection

polymarket

strategy

math

python

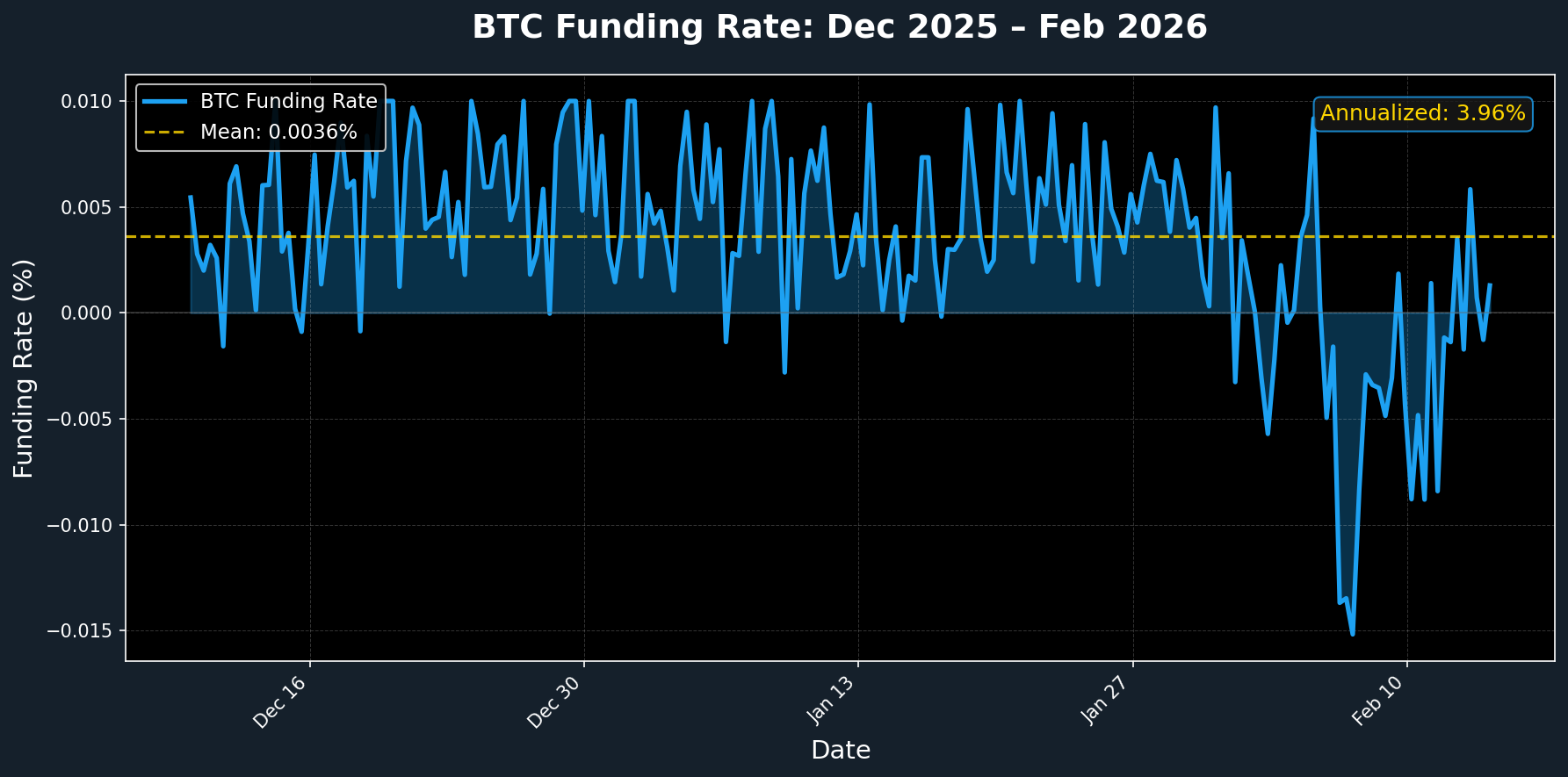

Day 1: The Funding Rate Free Lunch (And Why It’s Getting Stale)

Perpetual Futures

Arbitrage

Market Microstructure

Day 2: When the Crowd Is Wrong About Being Wrong

Perpetual Futures

Contrarian Signals

Market Microstructure

No matching items